There have been few branding shake-ups as large and wide-ranging as the financial sector. In such a rapidly evolving market, how do traditional finance brands successfully position themselves against challenger banks?

After decades of ‘brass plate and navy’ branding from the ‘big four’ who oversaw a virtual monopoly on the sector, new disruptors and challengers have made themselves known.

Challenger banks sought to differentiate themselves from their larger rivals with bright colours, friendly communications and a digital-first approach. And they have largely succeeded. A new finance marketing rulebook was born.

In the face of this, banking and finance brands risk being seen as archaic and stuffy if they don’t keep up. So how do longstanding finance brands position themselves against challenger banks like Monzo and Starling Bank? Here’s the lowdown.

The current state of banking and finance branding

As major historical institutions, banks have always leaned on a reputation of trustworthiness and stability. Trust that a customer’s money is safe, stable and secure. Communications often had a healthy dose of banking jargon and legalese to create a sense of authority and status.

And then the 2008 financial crash happened. Public trust in the financial sector plummeted. People started looking for alternate options. The challenger banks entered the arena. Or more precisely – the market.

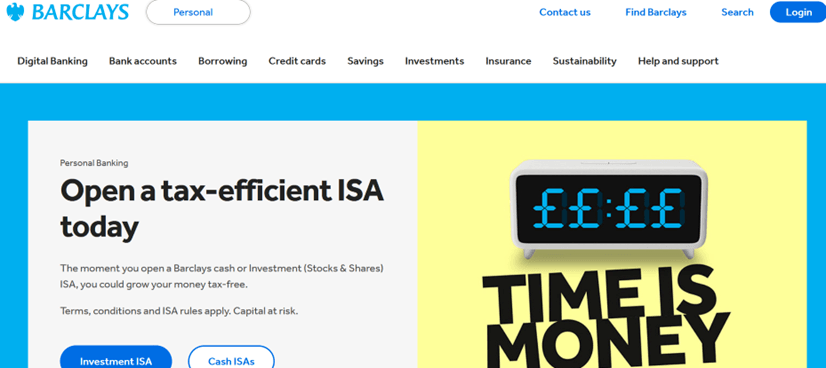

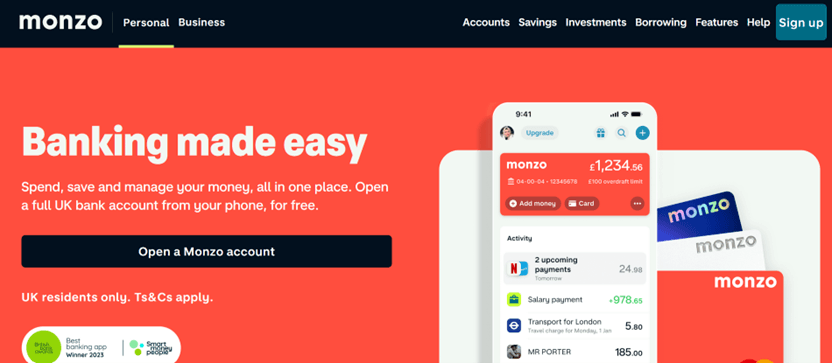

One of the key opportunities that the challenger banks noticed was in the customer experience. All the traditional banks gave customers a very similar experience. The financial sector rule book had not been challenged in so long that traditional banks vied for new customers by promoting products rather than easy and pleasant experiences. Take a quick homepage comparison below as an example:

Barclays leads with a product…

…while Monzo leads with the customer experience.

But customers now want more than somewhere to store money. They are increasingly looking for services that are flexible and can fit into their busy lives. This means a more convenient experience delivered with more human, friendly communications using language that people actually understand.

How to overturn the ‘rules’ of finance marketing

The fundamental difference here is the switch to a people-first approach and human-centred design.

Traditionally, banks have a somewhat impersonal and cold reputation – all marble façades and bowler hats. And even if the promotional advertising is friendly, customer service teams often speak in confusing jargon and legalese. This is intended as a reminder of the importance of money – but doesn’t make for an enjoyable experience.

Working with design consultancy Fjord, NatWest embarked on a review to determine how the bank could respond to changes in the financial sector. It revealed some hard truths about the state of finance branding in the world of traditional banks. There was a clear disconnect between how banks and people talk about money. Communications often focused on when things went wrong (you went into an unarranged overdraft) or pushing new products. There was little in the way of proactive advice or help reaching financial security.

Finance marketing: disrupting the status quo

Monzo’s tone of voice

From the hot coral bank cards to the quick sign up process, Monzo have set out to make themselves everything that traditional banks are not. Visually, their 2022 rebrand sought to cement this with illustrations that are far removed from the flat geometry and stock image people that commonly appears in finance marketing.

But the real focus has been on the idea of friendliness. The cornerstone of this approach is a clear and consistent brand tone of voice that is present across every customer touchpoint. Creative Review attribute tone of voice as being key to Monzo’s success. “Having a clear and consistent tone of voice is vital for a bank that positions itself as one that is transparent and inclusive. It has also helped the bank gain people’s trust in a sector where trust has been eroded.”

On the language itself, a lot of work has gone into making bank jargon and legal terms understandable. Monzo writer Harry Ashbridge sums it up succinctly: “We use the language our audience uses, and make technical stuff as clear as we can.”

Starling Bank’s people-first approach

Where Monzo opts for friendliness, Starling Banks goes for relatability. An emotional approach to finance marketing has been building for the past decade and Starling have been at the forefront. Styling themselves as ‘the bank built for you’, Starling’s recent campaign shows relatable human stories to highlight different ways of managing money. People who see themselves in these stories know that this is a bank that understands its customers and this reflects well upon the brand.

Underpinning these relatable and emotionally engaging campaigns is Starling’s founding mission to “change banking for good”. A clear reference to the collapse in customer trust after the financial crash. Connecting brands to a wider social purpose ties into the increasing trend of customers who choose brands that share their values. And back it up with a people-first approach championing convenience and proactive advice.

There have been a number of attempts from longer standing financial institutions to adapt their messaging in the face of the new finance marketing playbook. Here are a few notable cases with varying degrees of success:

Natwest’s Bó

Riffing off Facebook’s feature-stealing tendencies, NatWest decided to challenge the challenger banks at their own game. Bó, an app-only brand, took many elements of the popular neobank experience – colourful cards, spending alerts, savings features and an app-only experience. But crucially, it didn’t have some of the more advanced features that banks like Monzo and Revolut offer. Simply trying to replicate Monzo’s model didn’t work, NatWest abandoned Bó after only six months.

In other words, trying to build a new brand from scratch to directly compete with digital native banks might be asking a lot. Brand heritage, legacy and awareness count for much.

First Direct’s financial wellness

One of the original disruptors in the banking sector, First Direct is now being challenged by the new generation of banks for convenience and customer service. Their recent messaging has focused on the campaign for ‘financial wellness’. That is, to recognise that good financial management is a critical part of our overall sense of wellbeing. It’s a strong concept that makes sense for an audience feeling crushed by a cost of living crisis.

The drawback is that there is no suggestion of tangible features or actions that will help customers towards financial wellness. Just the pre-existing customer service. Tying your brand to a wider social purpose is a strong step but it must be backed up by tangible action. Otherwise, it just looks like you’re jumping on the bandwagon. #wellnesswashing

Nationwide’s brand refresh

Nationwide are not a traditional bank but they do have a financial brand stretching back to the 1880s. The building society recently revealed a major new rebrand with a notable change in brand tone of voice.

Alongside a streamlined visual identity, Nationwide are drawing on humour in a notable departure from their previously earnest promotions. Taglines such as: “Hi street.” and “Going going nowhere” reinforce their central pledge (or ‘Branch Promise’) to keep physical stores open – prioritising the experiences that matter most to their customers.

In other words, Nationwide sought the sweet spot between this new friendly and fun tone for finance marketing while leveraging their heritage and brand recognition. And signs so far are positive.

Round Up: Remember the basics of branding

These real-life tales of finance marketing demonstrate why finance branding needs to be rooted in the basics. Listen to your customers to develop a people-first approach. Build emotion-based connections for stronger lifetime value. Embody your brand values with tangible actions. Look to provide additional value at every opportunity. And most importantly, create convenient and friction-free customer experiences with clear and consistent communications.

The finance brand landscape is rapidly evolving. Don’t get left behind. Give the SIM7 team a call.